Existing Buildings

Projects financed through PropertyFit can eliminate a property owner’s upfront investment and create immediate positive cash flow. PropertyFit financing can also lower operating costs, improve the value and market competitiveness of the asset, and help the property achieve energy performance mandates. Let’s compare PropertyFit with owner-funding and traditional bank financing for a $350,000 project that generates $40,000 annual utility cost savings.

Owner Funded

In this example, the project requires a $350,000 cash investment from the owner that would take nine years to recoup. If the owner doesn’t have that type of cash, can’t wait nine years to recover their investment, or plans to sell the property in three or fewer years, this project likely won’t move forward.

Traditional Bank Financed

Traditional bank financing may offer a lower interest rate than PropertyFit financing, but often requires the owner to invest a portion of their own cash into the project, typically a minimum of 20 percent of project costs. And, while the monthly payment amount may be based upon a 20-year amortization period, bank financing usually has a 5 to 10-year balloon payment which requires the owner to refinance the debt. Given these parameters, the bank financing in this example would require a $70,000 cash investment from the owner and would initially take 3.7 years to become cash flow positive. However, because of the balloon payment due in year 10, the actual payback period is just over 15 years.

Financed with PropertyFit

Now take a look at PropertyFit financing. PropertyFit covers 100 percent of the cost of the project, requiring no cash investment by the owner. The weighted average life of the improvements being installed is 25 years so the entire PropertyFit financing is fully amortized over that term—no balloon payment or need to refinance at a point in the future. And, even though the interest rate on the PropertyFit financing is higher than the bank financing, the project is cashflow positive in year one.

That’s how PropertyFit can shift what was once a capital expenditure into a cash flow positive investment in improved building performance. Run the numbers for yourself to see how PropertyFit can change the value proposition in your project.

Leasing Structures With PropertyFit

PropertyFit benefits both landlords and tenants under multiple leasing structures:

Gross Lease

Under a gross lease the landlord is responsible for payment of all utilities, real estate taxes, building insurance, common area maintenance, and repair expenses. The landlord recovers these costs from tenants through the base rents. As a result, energy or other resource savings from a PropertyFit-funded project will flow directly to the landlord’s bottom line.

Triple-net Lease

Under a triple-net lease, tenants are responsible for utility costs in their space. Real estate taxes, building insurance, and common area repair and maintenance are passed through to the tenant on a pro-rata basis based upon the leasable square footage they occupy.

In this scenario, energy savings generated from an investment made by the landlord go directly to the tenant’s bottom line. This split incentive – landlord investment/tenant benefit – is the reason why so few sustainability projects are undertaken by landlords at properties with triple-net leases. With PropertyFit Financing, no upfront cash investment is needed from the landlord and the PropertyFit benefit assessment can be recouped from tenants. At the same time, tenants can see an immediate cash flow increase from utility bill savings that exceed the assessment amount.

New Construction

PropertyFit is one of the first programs in the nation to offer property assessed financing for new construction projects which can accelerate the development of greener, more efficient buildings in Multnomah County. This innovative new financing tool unlocks capital to achieve superior building performance at more favorable terms then traditional mezzanine debt or preferred equity. It will change the makeup of your capital stack and can significantly reduce your weighted average cost of funds.

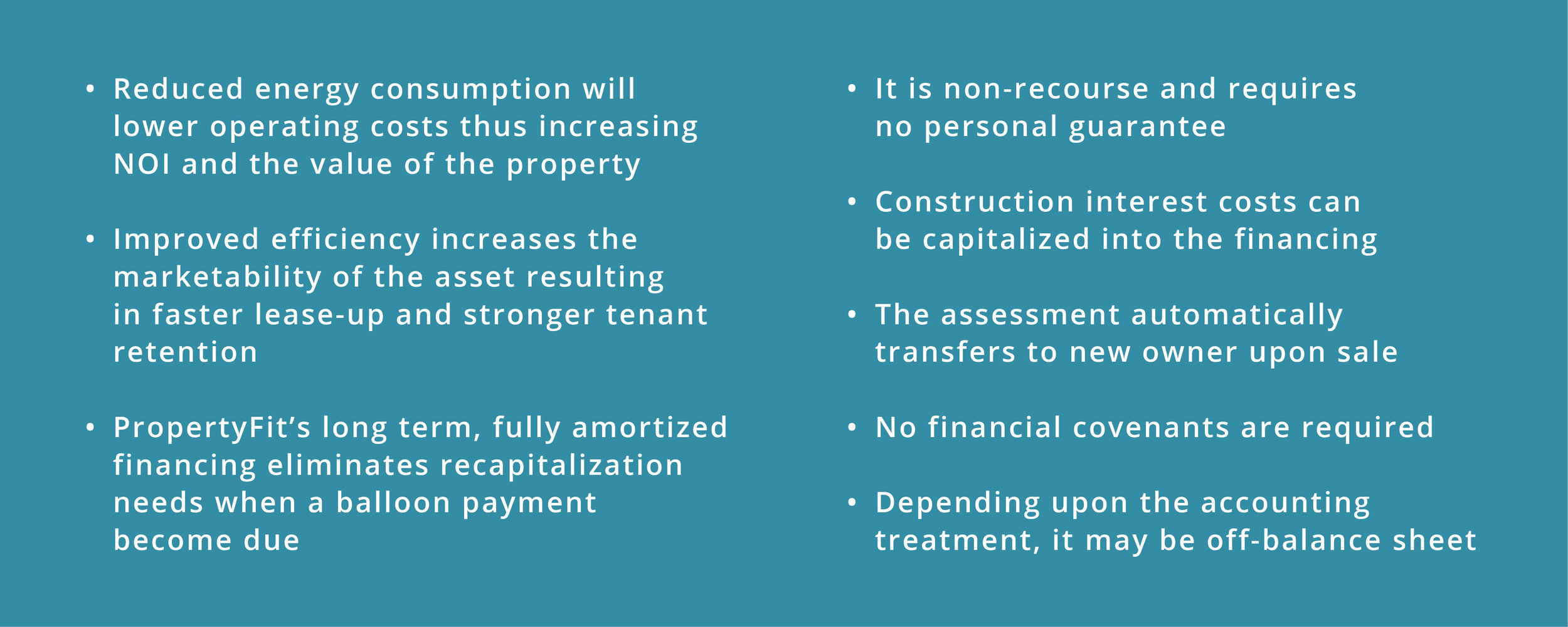

And, if improved building performance and reduced costs of funds aren’t enough, PropertyFit’s unique structure offers other valuable improvements over the traditional capital stack. Take a look.

To qualify, projects must exceed energy code (ASHRAE 90.1 – 2016) by at least 5 percent. If they do, PropertyFit can finance up to 20 percent of eligible construction costs. Eligible non-energy improvements (e.g. seismic) may increase the maximum total financing amount to up to 30 percent of the “after completed” value of the property. Click here for details on new construction technical standards.

Let’s compare PropertyFit's impact in a sample $10 million new construction project.

Investment terms vary by investor and type of capital invested. We’ve assumed the following investment rates in the chart on the left.

In this example, PropertyFit financing can substitute for 100 percent of the project’s mezzanine debt needs. The result is a reduction in the overall cost of funds by 80 basis points, equating to $80,000 in annual cost savings for this example.